Presidential Election Year Investing

The answer no one wants to hear to the question everyone is asking

Like clockwork those of us in the investment advice business ALWAYS get some form of this question: “How should the presidential election affect my investments?”

The implications fall somewhere along these lines including multiple applying at the same time:

What if the other (wrong) guy wins?

Rarely at first but then greatly if it is looking likely - What if my guy wins?

Should we sit this out and get back in once we know (once it is over)?

Will the market (go down/stay down/rally/be more volatile/be less volatile) at some point (before/after) the election?

All of these amount to “Can we outguess the market on this one question everyone is asking for this well-known event that has very specific parameters on it?

I don’t blame people for asking about how a presidential election might impact their investment. I just wish we’d learn to accept the answer:

IT. DOESN’T. MATTER. At least not in any way you can possibly hope to profit from.

“How can this be?” I hear you ask. “Isn’t this ‘the most important election in our lifetime™’?” No, it is basically just another election. This is especially true regarding investing.

To the degree the government in general and the executive in particular has grown more powerful, it is more important. But unfortunately that doesn’t make it more investable or predictable.

Here is a partial list of why not:

Businesses adjust to new realities. Change doesn’t happen in a vacuum. Business leaders pivot to avoid harms a new administration might bring as well as to capitalize on opportunities that arise. Industries lobby to bend changes in a favorable way. Yes, there will be losers and winners, but it is much, much harder to predict who these will be than the average investor thinks.

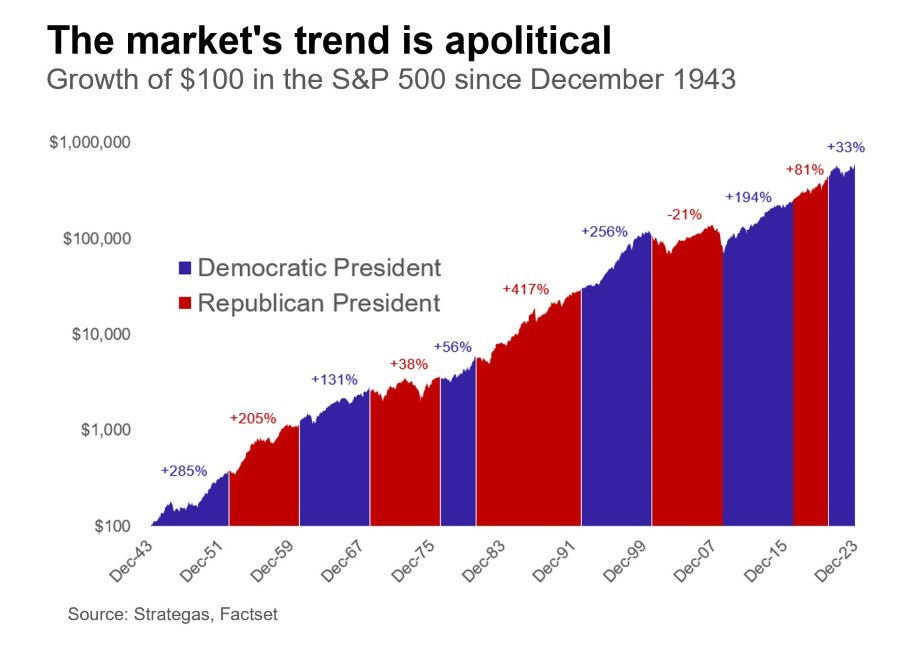

Markets price things in. Many of the adjustments you might think to make have already been made before you conceived of them. You can make a bet on how things will play out if things play out a certain way, but the key word here is “bet”. I almost never get this line of questioning from clients who are interested in making high-risk investment positions. You may think you are seeking to avoid risk, but you are simply betting against the tide of history (see graph below).

There are many elections going on (hundreds that same day at the national level, hundreds more that same day at the state and local level), there will be more elections in the months and years ahead (including before the next presidential vote), and there will be future presidential elections. Putting a lot of emphasis on just this one seems right but is wrong.

Their rhetoric greatly exceeds their actual output. This is very fortunate and a tribute to our system of limited government. They say a lot of [stuff] and end up doing a very little. And what they do do is usually quite watered down once it comes to fruition.1

Besides, they aren’t too different. One of my themes recently is how Trump-like Biden has been especially on economic issues such as industrial policy, tariffs, immigration2, etc. And the long-running charge of their being a uniparty isn’t based on nothing.

As Baird points out, the market is apolitical. “There are a million things that the market cares about—such as earnings growth and economic growth—before it cares about the politics of the day.” Thinking that the market cares about the presidential election the way you care about the presidential election is a form of main-character syndrome.

Don’t let a silly thing like a presidential election get in the way of an important thing like your long-term financial goals and plan.

The allusions here are intentional.

Despite what you’ve heard, the rates of rejection and policies have been very similar. It is just the level of immigration that is vastly higher under Biden. And yes, some of this level is due to a difference in rhetoric and policy between the two.